equity platinum fund 2

Equity Residences is redefining vacation home ownership by making it an affordable and financially attractive investment. Our third fund, the Equity Platinum Fund 2, is purchasing exclusive luxury vacation residences in Hawaii, California, the Caribbean, and other highly coveted vacation destinations.

This vacation investment fund’s objective is to raise $50 million from accredited investors to acquire up to 16 multi-million dollar luxury investment homes in locations that feature world-class services and amenities, such as ski-in ski-out and beachfront locations and to provide access to private residence clubs, golf course options, and more.

WHY INVEST IN A LUXURY VACATION FUND?

An Innovative Investment

Equity Residences is a luxury real estate private equity fund and an investment vehicle that allows multiple investors to pool their capital and co-own a portfolio of vacation homes. Our investors can benefit from the rental income from these homes and take rent-free vacations across Equity Residences portfolios.

Managed by a team of experienced finance, hospitality, and real estate professionals with a successful track record in the industry

Funds operate debt-free and act as a capital preservation play for investors who want to diversify their portfolios with luxury vacation homes in the world’s top destinations

A Smarter Way to Invest In Second Homes

No annual fee option (annual fees can be offset through a reduction in vacation use)

Dividend opportunity based on excess rental income

>90% of capital invested in real estate

Investment in “bought-right,” multimillion-dollar vacation residences with high potential for investment gains

Liquidation and profit distribution within a set time frame

An Innovative Investment

Rent-free luxury vacations with friends and family in any of the portfolio homes

No blackout dates. You have the freedom to use the residences for holidays or whenever it suits you.

Access to hundreds of luxury homes around the world through partnerships with Elite Alliance and THIRDHOME

Personal concierge services including a personal chef, pre-stocked refrigerator and access to sports and leisure equipment

INTRODUCING VACATION HOME OWNERSHIP WITH THE EQUITY PLATINUM FUND 2

Equity Residences Managing Directors John Long and Greg Salley lead a 45-minute webinar that discusses the company’s business model and introduces the Equity Platinum Fund 2.

Watch the webinar to learn about:

0:45 Equity Platinum Fund 2 investment overview

03:48 Equity Platinum Fund 2 target destinations

07:06 Latest Equity Platinum Fund 2 home acquisitions

12:19 Equity Residences portfolio overview as of April 2023/p>

26:40 Equity Residences portfolio overview as of April 2023

33:12 Case study on how we buy our homes to generate returns

38:24 Equity Experience: private club access, concierge, dream trips/p>

44:22 Equity Platinum Fund 2 ownership details: pricing, usage options, annual fees, projected returns, investment summary

52:16 Examples of best-in-class investment value and investor testimonials

56:10 Q&A

Equity Platinum Fund 2 Portfolio

Equity Platinum Fund 2 investors will own a diversified portfolio of 16 luxury vacation homes ranging in locations from Hawaii to Europe. These various types of homes are well-maintained and include a wide range of amenities and services to guests. With a portfolio of 16 homes located in some of the most desirable locations in the world, investors can benefit from diversification and the potential for higher returns through vacation home ownership.

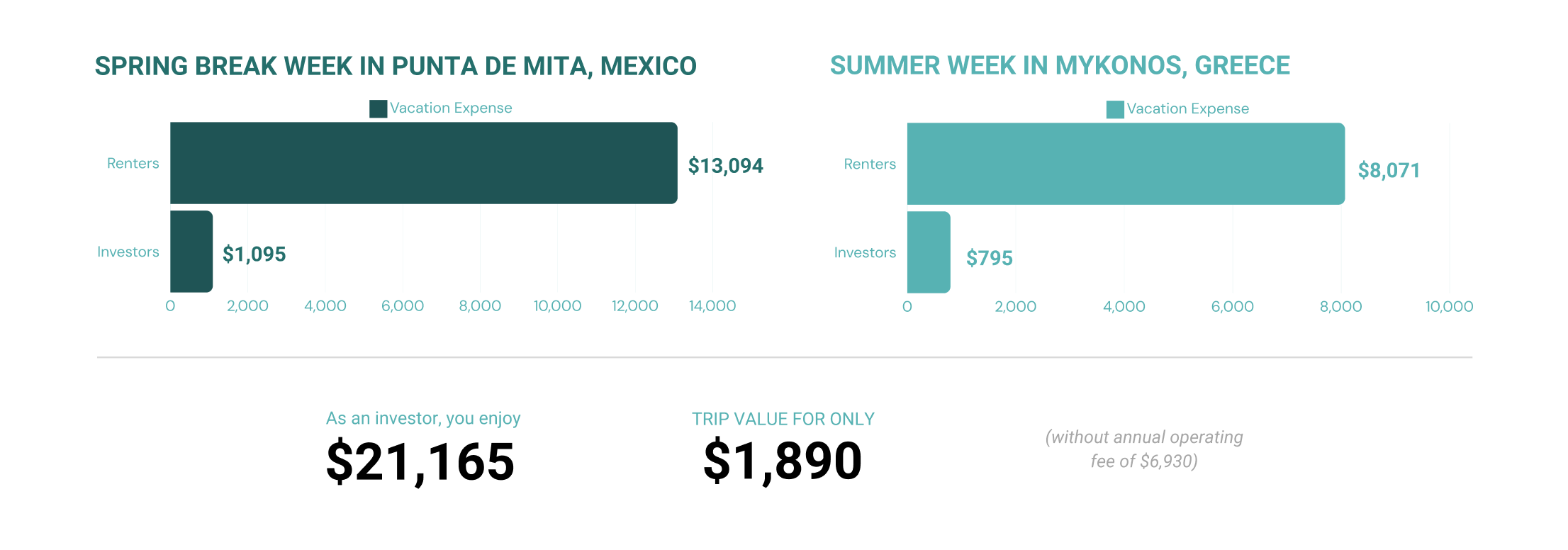

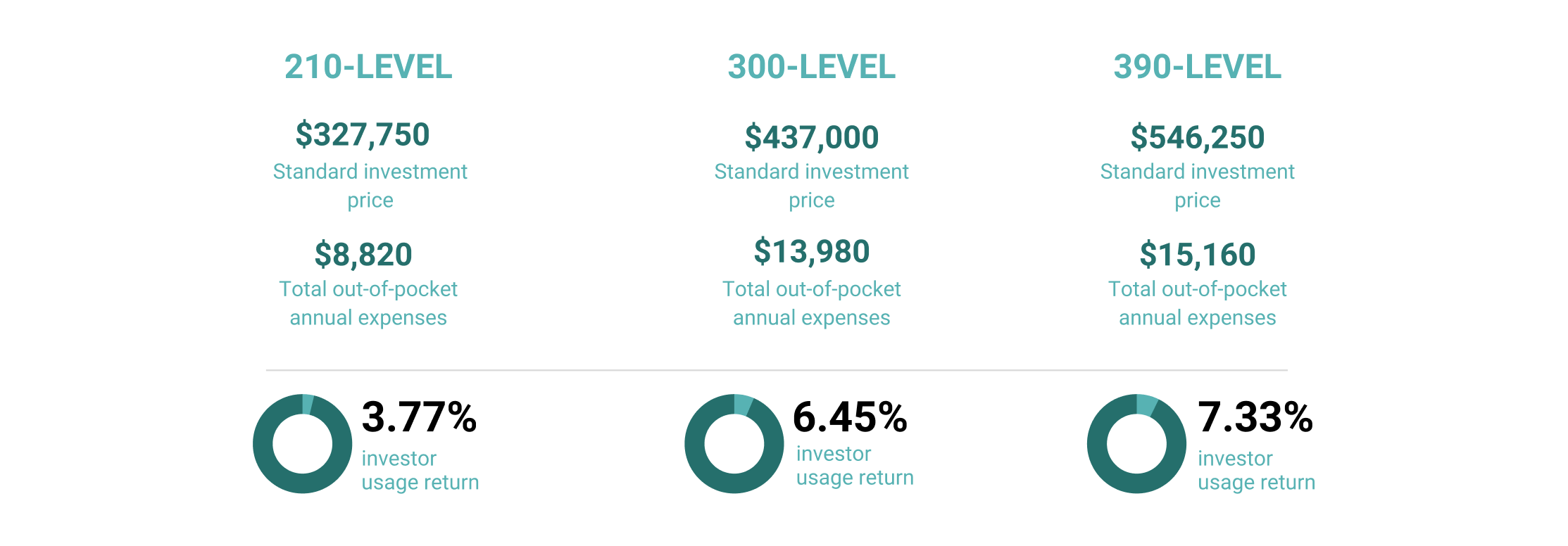

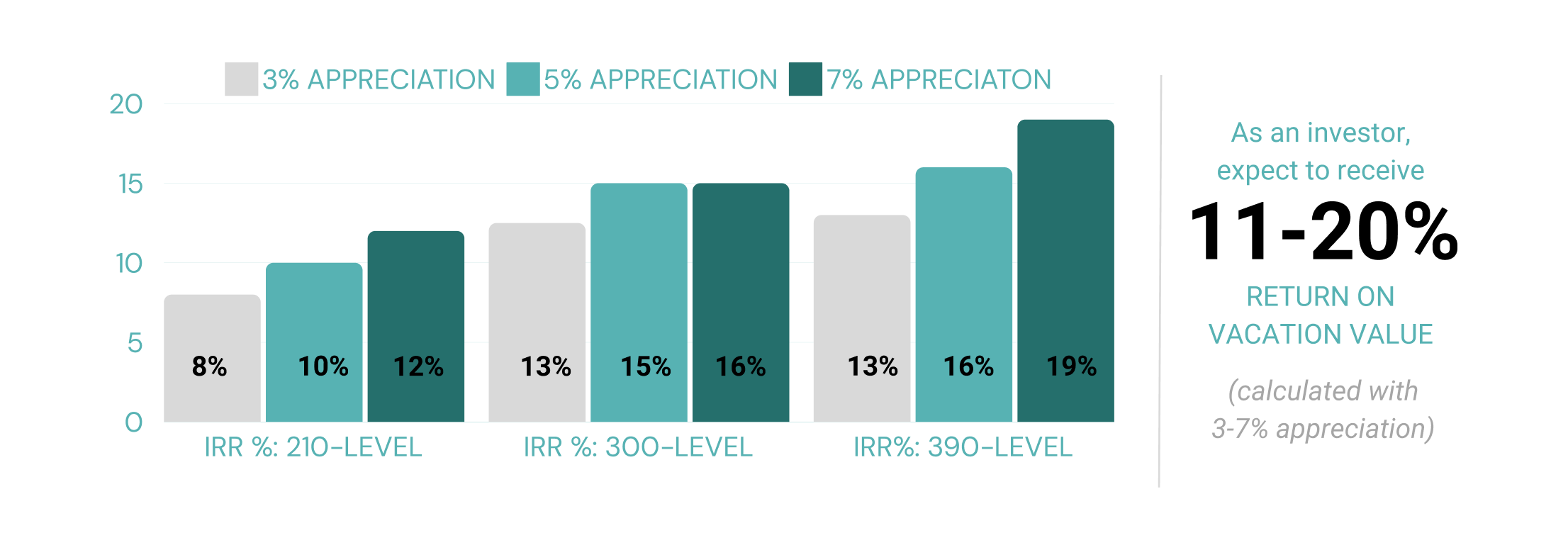

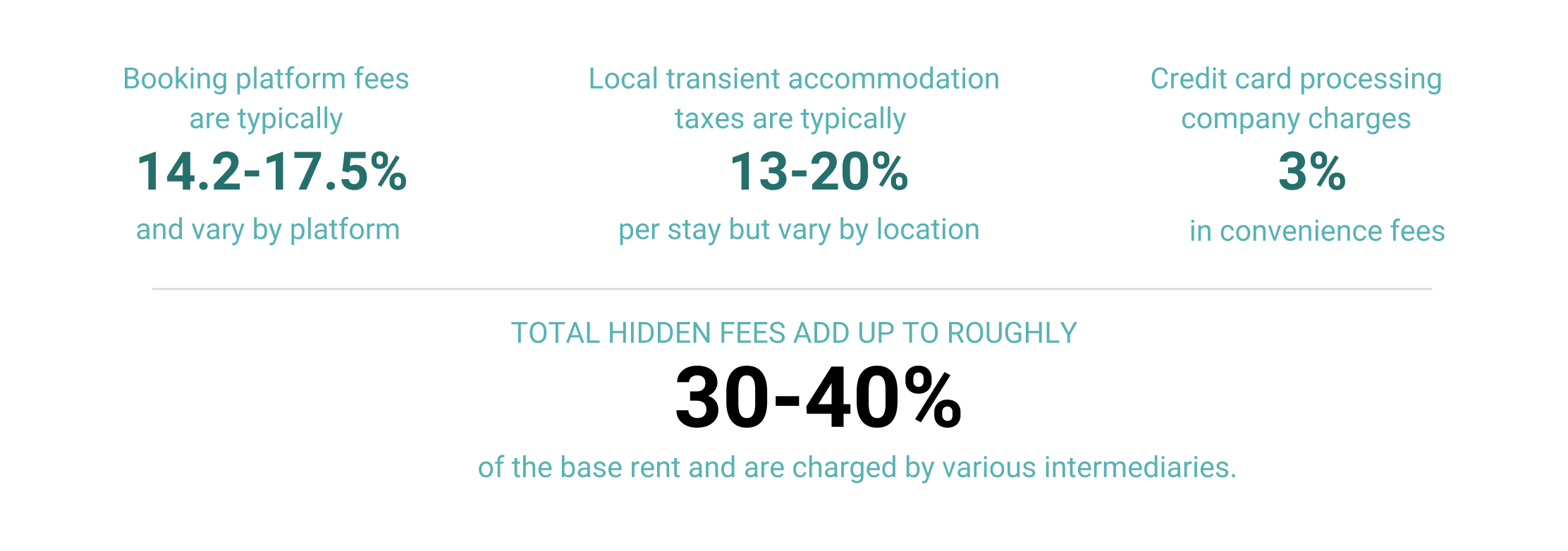

Calculating Your Potential Investment Return

This infographic shows examples of how, as an investor with Equity Residences, you can enjoy top- tier vacation homes at a fraction of the cost renters pay while securing promising returns on your investment.

ANNUAL VACATION EXPENSE (210-LEVEL): RENTERS VS INVESTORS

YOUR USAGE RETURNS ACROSS 3 INVESTMENT LEVELS

INTERNAL RATE OF RETURN (IRR)

AS AN INVESTOR, YOU AVOID PAYING THE FOLLOWING:

FAQ

What is Equity Residences?

Equity Residences is a pioneering luxury real estate private equity fund, tailored for accredited investors seeking a low-risk entry into luxury vacation home ownership. We specialize in offering portfolio ownership opportunities of upscale vacation residences worldwide, with a strong focus on a debt-free approach and a defined asset liquidation timeline. Over 90% of our raised capital is invested directly into select vacation homes, providing investors a diversified real estate portfolio and a hassle-free alternative to direct home ownership. Our model guarantees access to top-tier, professionally managed second homes, enhancing your investment portfolio with minimal direct ownership responsibilities and rent-free vacations.

How Does The Luxury Vacation Residence Fund Model Work?

Our investors make an upfront capital investment, and in return, they receive an equity interest in the fund’s portfolio of luxury vacation homes. The investment period is typically 10 years, and at the end of the term, the fund is liquidated, allowing investors to realize the full value of their investment and receive anticipated appreciation proceeds. Additionally, our investors enjoy the luxury of rent-free vacations in these upscale residences throughout the investment term, blending financial growth with lifestyle enrichment.

Investor Involvement: What’s Required?

Investors benefit from a passive investment experience. Our expert management team adeptly handles property acquisitions, maintenance, and investor communication. This hands-off approach ensures peace of mind and successful portfolio growth, coupled with the added luxury of selecting vacation destinations across our expansive residence portfolio.

Do fund owners have reservation priority in their own fund’s homes?

A standout feature of our real estate fund is the priority access granted to investors for vacation residences within their specific fund. In scenarios where multiple investors select the same property for vacations, co-owners in the relevant fund receive precedence. This exclusive access eliminates the typical booking challenges and ensures a tailored, hassle-free vacation planning experience.

Why invest in Equity Residences’ luxury vacation real estate fund?

Investing with Equity Residences offers a unique blend of luxury travel and financial acumen. Our investors enjoy a diversified portfolio of premium vacation homes and the ease of a passive investment structure, all under professional management. This approach not only elevates your travel experiences but also strategically enhances your net worth with minimal ownership complexities.