Table of Contents

We receive a lot of questions asking us to share the stories behind our Equity Platinum Fund home acquisitions. We are also asked how we target upcoming additions to the Equity Platinum Fund portfolio.

We created this webinar to answer many of your questions. Watch to find out how we source economically sound real estate deals that also satisfy our investors’ desires to take luxury vacations.

We are working diligently to acquire more homes in top vacation destinations to move us closer to our goal of a 20-to-25-home Equity Platinum Fund portfolio.

Currently, there are six homes in the Equity Platinum Fund portfolio for our investors to enjoy. There are ten homes owned by our first fund, the Equity Villa Fund, that can also be reserved by the Equity Platinum Fund investors.

To maximize appreciation potential, our funds hold homes for ten years and then liquidate the real estate and return the original investment plus appreciation back to the investors.

Prior to liquidation, investors can enjoy the Fund homes rent-free. They can also receive dividends based on the portfolio performance.

How We Identify The Best Homes For The Equity Platinum Fund

Before acquiring a home we focus on three attributes:

1. Exceptional rental rate and occupancy track record or potential

2. Exceptional appreciation potential

3. Exceptional vacation experience for our investors and renters

4. We also take a look at the regulatory environment to make sure our business model is a permitted use for the targeted home.

During The Past 7 Years, We Have Demonstrated Expertise In The Following:

1. Opportunistic acquisitions

2. Buying at market lows around the world

3. Developer negotiations, sometimes with private equity firms

4. Smart, cost-effective upgrades

5. Evaluating different markets simultaneously

6. Developing a network of contacts in different markets (developers, private equity firms, property managers, realtors)

7. Successfully applying an analytical approach

8. Moving quickly but prudently with all-cash offers

Equity Platinum Fund Portfolio Illustrative Acquisitions

Seacrest Beach, Florida

Our Seacrest Beach, Florida home is an example of an opportunistic purchase. The seller had the home under contract with a buyer predicated on a 1031 exchange. The buyer failed to perform, and the seller was at risk of losing another home, the purchase of which was dependent on the failed transaction.

When the buyer did not perform, one of the top realtors in the market suggested we step in and save the deal for the seller. We agreed to an all-cash purchase and a nine-day close in exchange for a $200,000 reduction from the previous contract price, which was significantly below the market price indicated by the local comps.

As shown by the chart below, the comps at the time of purchase traded at $692 per square foot. We bought the house for $592 per square foot. Including the cost of a remodel, which increased the market value, we ended up at $668 per square foot.

A recent comp four houses down the beach sold for $901 per square foot, indicating 35% appreciation in less than 2 years.

Equity Residences Seacrest Beach Florida home price analysis

Potrero Beach, Guanacaste, Costa Rica

The Potrero Beach home is bordered by water on two sides: The ocean directly in front of the home and a tributary behind it. The residence is surrounded by lush nature and is a short walk to shops, restaurants, and a beach club. Located in a gated community with 24-hour security, the home boasts four bedrooms, four and a half baths in an up-and-coming area that features a newly opened microbrewery.

Purchased for $1.38 million, we believe this home would now sell for more than $2 million.

Cap rates in Costa Rica are excellent as well. Rentals in the area gross $200,000 – $300,000 per year, and we should be on the higher end of that range. The home sits on a deeded lot, which is rare in Costa Rica since deeded land constitutes only 2.5% of available land in the country.

You can learn more about the Costa Rica acquisition on our blog.

Penthouse in the heart of Siena, Tuscany, Italy

The Equity Platinum Fund Siena apartment is perfectly situated in the old walled city, just moments from the main piazza. As soon as you walk out the front door, you are surrounded by romantic cobblestone streets. Although this is one of the smaller homes in our portfolio, it can comfortably accommodate up to eight people. The home features a master suite, a junior suite, and a smaller third room which is perfect for kids.

This acquisition is an example of how we bought at the bottom of the market when home values in Tuscany were at 15-year lows.

When we went there, we were looking at some old ruins in the countryside to possibly restore. However, the many building restrictions associated with the ruins’ historical designation and a pronounced rental seasonality made us shift away from the Tuscan countryside and focus on a more convenient location. better rental potential, and a less complicated transaction.

We began looking at alternatives and recognized opportunities within the charming old walled city. We ended up acquiring a penthouse there, just a short walk to the main square, Piazza del Campo. Due to a local real estate depression triggered by a bank failure, we were able to negotiate an excellent deal for the Fund. When the time comes, we believe we will have the opportunity to sell to Italians as well as foreigners who, justifiably, love the area.

Read more about Siena and how we renovated the apartment on our blog.

Cap Cana Resort Villa in the Dominican Republic with full-time staff

Our home within the Cap Cana Resort in the Dominican Republic is situated on Punta Espada, one of the most beautiful golf courses in the Caribbean. The resort also affords beautiful ocean views and is only 15 minutes from the Punta Cana airport. The home features a live-in butler who will make you breakfast or bring you a drink as you lounge by the pool.

Our Cap Cana villa acquisition is an example of taking advantage of a distressed market. Many developers in the Cap Cana Resort went bankrupt because real estate there, like most other places, took a big hit during the Great Recession. We were able to get there in 2014 and start negotiating the deal.

Cap Cana attracts visitors from the U.S., South America and Europe. We can drive excellent cap rates here, partially because of the price points we were able to purchase here.

Mauna Lani Resort Villa, Big Island of Hawai

Our four-bedroom, four-and-a-half-bath home at the Mauna Lani Resort on the Big Island offers incredible ocean and sunset views. One of the things that makes this home unique is that it is located right on the golf course and, it is close to a private beach club which is available to our investors and renters. There is also access to a cove for those who want to do some snorkeling, a great activity for everyone in the family.

The Mauna Lani was new and was acquired directly from the developer. This home rents for $2,000 or more a night on the open market. We love this home because Hawaii has low seasonality, which drives high cap rates. We also have high investor demand for Hawaii, so this home is good for us.

A ski-in/ski-out house at Northstar Resort, Lake Tahoe

Our home at Northstar Resort in the Lake Tahoe area is right on a ski run and next to the Ritz Carlton. It features four bedrooms, a home theater room, a pool table, and two pull-out sofas. There is also a private fire pit, a private hot tub, and access to The Tree House private club. The home also features boot warmers to keep your ski boots warm after a day of skiing. It is a great place to visit during the summer and winter. The home has four bedrooms and three and a half baths.

Within Tree House club, you’ll find an Olympic-sized pool, hot tub, gym, basketball court, media room, game room, in addition to a bar with beer, wine, and soft drinks.

Tree House also has an on-site concierge called the Outfitter that can get skies delivered for you, arrange mountain biking, hiking, private chef and other activities.

This home is another example of a purchase negotiated directly with the developer. The developer had six identical homes for sale. We bought it at a net price of $2.9 million. We negotiated an extended closing, so by the time we closed, one of the other homes sold for $3.5 million and another one was purchased for $3.6 million.

We also negotiated an exclusive right for the home to be owned by a multi-investor fund. None of the other houses have that right. And we negotiated a right to transfer that to the next buyer, which we think will give us a premium on the exit.

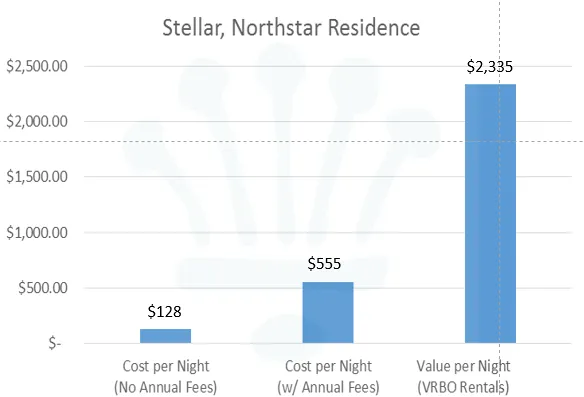

If you were to rent this home during a typical ski season week it would go for $2,335 a night. If you book it through the Equity Platinum Fund as an investor, your effective cost is $555 per night. “Effective” means that the only price you pay is a nominal visit fee, which covers the cleaning and setup costs when you arrive. Those costs range from $300 to $900 throughout the portfolio

What the $555 represents is the cost per night that factors in an annual operating fee, which for one-unit investment is $2,988. And you factor in part of your cost per night calculation.

Platinum Fund investors can opt to eliminate their annual operating fee. In this case, you can book a home. If you book a house without paying an annual operating fee, your cost per night comes down to $128.

Again, this is not something you would be paying per night; this is just an effective cost of the investment on the annualized basis for you.

Equity Residences Northstar Resort Lake Tahoe ski-in/ski-out home investor annualized cost per night

Equity Platinum Fund Targeted Portfolio

The homes in black are currently owned by the Platinum Fund. The white colors indicate the 14 locations we have targeted for home acquisitions.

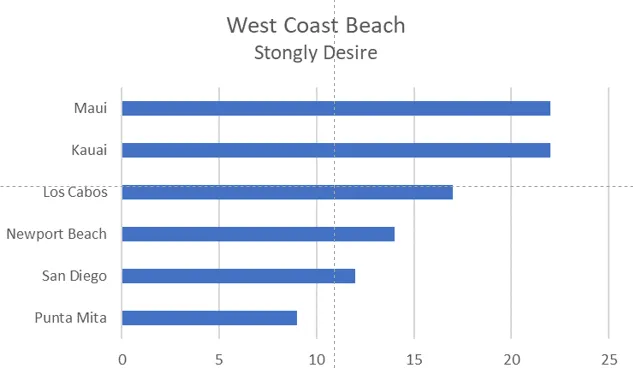

Our East Coast investors have told us they want homes in the Caribbean so we are researching Turks and Caicos, Grand Cayman, and the Bahamas. West Coast investors want to go to Hawaii, so we are looking on Maui and Kauai, to add to our Big Island option.

We will be acquiring homes in Los Cabos and the Mayan Riviera, Mexico, along with more European properties. Greece is high on our investor survey results.

We Listen To Our Investors

Equity Residences reaches out to our Platinum Fund investors annually for input on where they want us to acquire additional homes. Starting with the most desired geographic locations, we search for the best investments based on the stated criteria – exceptional rental rate and occupancy; exceptional appreciation potential; exceptional vacation experience.

The order in which we acquire may not be sequential to the survey rankings. If I found a fantastic opportunity in the Grand Cayman, I might buy there before I buy in Turks and Caicos.

Investor feedback gives us guidance on prioritizing locations but the “best deal” may trump a higher ranking.

Beach Destinations for West Coast Investors

Maui and Kauai in Hawaii are both highly desired destinations for our investors. We are working closely with a developer on Maui for a unique opportunity. It’s almost impossible to find places on Maui that are fit for short term occupancy. The process is difficult – you need to buy a home and secure your neighbors’ permission for short-term rentals. And this needs to be renewed each year. So, if they change their mind, you are not going to be allowed to rent there.

We solved this dilemma by talking with a developer early when they only had land under contract. The land is near Wailea, and it has 180-degrees sunset views. They are dividing the land into 16 lots 5-15 acres in size. Each lot can then be subdivided into two homes. Because of the size of the lots, they have to be far from one another so neighbor rental approval is not an issue.

This will allow us to have an estate-type home five minutes from the beach, views of the ocean, close to some of the restaurants. Oprah Winfrey has a large estate close by.

We believe this is going to be a great addition to the Fund. The uniqueness of the home should drive a high cap rate and significant appreciation upon resale.

Another place we are looking at is Los Cabos, Mexico. This area was depressed after the downturn, but it is starting to recover, so you still can find good opportunities there.

Equity Residences 2018 investor survey results

Mountain Destinations Survey Results

Jackson Hole is a top priority for our investors. They like to ski there in winter and summer is a great time to visit because of the spectacular scenery and close proximity to Yellowstone and Grand Teton National Parks. This combination makes Jackson Hole very attractive to us. However, our challenge there is the high price of real estate, which makes economics challenging.

We may get creative there by jumping to Big Sky, a resort close to the Yellowstone National Park. Some large luxury hotels are slated for development there and that should drive future appreciation.

European and Urban Acquisitions

Our 2017 survey told us investors wanted a place in Tuscany and we accommodated them with a penthouse in Siena. Now on the list are Paris, London, Greek Isles, and New York City. We would likely acquire places in the Caribbean before we buy in Europe. We are also looking at Brexit and seeing what opportunities that creates as well.

The last part of the survey addressed spa, golf, and other leisure destinations. We will be looking at opportunities in the Napa/Sonoma wine country to add to the portfolio as well.

Third Home and Elite Alliance

In addition to the destinations currently in our portfolio, we also have two affiliates. The first one is Elite Alliance, a network of high-end, luxury, factional resorts and luxury homes that are professionally managed. They offer villas at resorts that usually range from two to four bedrooms. A typical resort has 100 villas and very high-quality standards.

Our second affiliate is ThirdHome, primarily a network of people’s second homes. The average value of the houses is $2.4 million, and they feature 10,000 homes in their network. The access to those home is less predictable because they are individual residences.

Both of these networks offer bonus usage 45-60 days out that do not require Platinum Fund credits. All you have to pay is a visit fee.

The Equity Residences Experience

Equity Residences strives to provide excellent investment returns and unsurpassed vacations. Our investor relations team is eager to help you arrange things such as pre-arrival grocery shopping, schedule a chef to come to your home, reserve tee times, arrange for child care, etc. We make the vacation experience seamless and relaxing by removing the worries and hassles.

If you want to learn about all aspects of vacation home investment yourself, consider reading our in-depth guide.